Lines 6: If you receiving social security benefits use the social security benefits worksheet to see if they are taxable. Lines 4 and 5: If you have Form 1099-R report the amount from line 1 on one of these lines depending on the type of income.

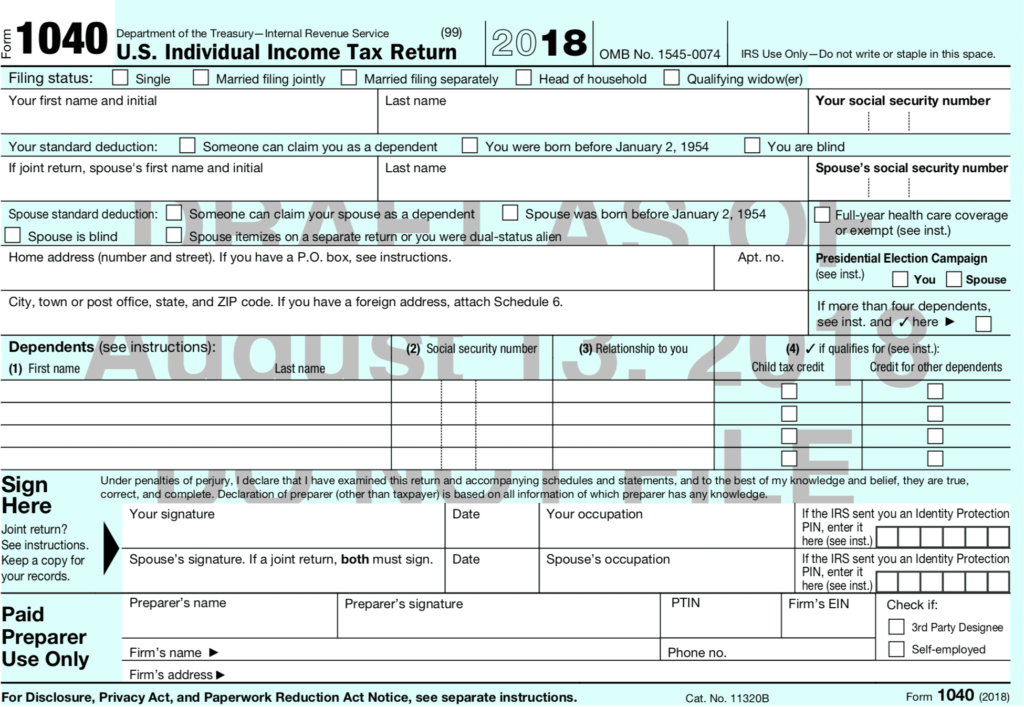

Lines 3: Report all the dividends you received along with Form 1099-DIV. Find this information on Forms 1099-INT and 1099-OID. Lines 2: If you received tax-exempt or taxable income during the year report it here. Get the information from your W-2 form and forms stated in these lines. Lines 1: If you are an official employee report all your wages and benefits here. In the next section of your tax return you would need to calculate your total taxable income: And also she is not a dependent and has no dependents so she leaves the rest blank. In this example, Jane has no income from digital assets, so she marks the answer “No”. In case you are not dependent or don’t have any dependents leave it blank. In the next section, you should provide information about your dependents if you have them. For example, digital assets include NFTs and virtual currencies, such as cryptocurrencies and stablecoins. Specify if you received or sold any digital assets during the year. Step 4: Additional Information and Dependents Jane Doe is single, so she marks it as her filing status and only adds her information. If you are married and filing a joint return, you will need to include your spouse's information as well. Go to the official IRS website and download PDF.Ĭlick the “Fill this form” button on this page as PDFLiner always has the current version of the form.Įnter your filing status, name, address, and Social Security number. To get started, you will need to access the 1040 form PDF. In our example, Jane Doe is a full-time employee who also received interest from her bank deposit, so she needs to gather her W-INT forms. Information about any tax credits you may be eligible for. Receipts for deductible expenses, like charitable donations or medical expenses. Records of any other income, such as rental income, interest, or dividends.

These may include:ġ099 forms for any freelance or contract work. Here are step-by-step instructions to complete a 1040 fillable form along with a simple example:īefore filling out the 1040 form, collect all the necessary documents and information. If you are a freelancer, contractor, or individual taxpayer with a simple tax situation, you might be able to fill out the form by yourself without hiring a tax professional. This form is issued by the Internal Revenue Service (IRS) and is used to report various types of income, deductions, and credits. Filling Out the IRS 1040 Form 2022 - 2023: Complete Guideįorm 1040 is the standard tax form individuals in the United States use to file their annual income tax returns.

0 kommentar(er)

0 kommentar(er)